If your income is above a certain threshold, you’ll need to pay the Additional Medicare Tax of 0.9% on income above the threshold amount. The IRS recently reminded taxpayers of what they need to know about this tax.

- Which income is subject to the tax? The tax applies only to the amount of certain income that is more than a threshold amount. The types of income include your Medicare wages, self-employment income and railroad retirement (RRTA) compensation.

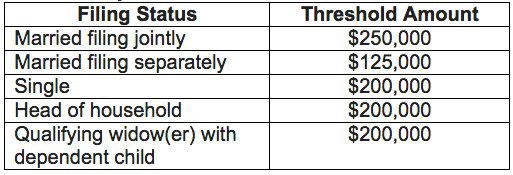

- What’s the threshold amount? You’ll base your threshold amount on your filing status. If you file a joint return with your spouse, you’ll need to combine your spouse’s wages, compensation or self-employment income with yours. Use the combined total to determine if your income exceeds your threshold. The threshold amounts are:

- Do I have to withhold? Employers must withhold this tax from employees’ wages or compensation when they pay an employee more than $200,000 in a calendar year. If you are self-employed, you should include this tax when you figure your estimated tax liability.

- What if I didn’t withhold or estimate properly? If you had too little tax withheld, or did not pay enough estimated tax, you may owe an estimated tax penalty. For more on this, see Publication 505, Tax Withholding and Estimated Tax.

If you owe the Additional Medicare Tax, you’ll need to file Form 8959, with your tax return. You also report any Additional Medicare Tax withheld by your employer on Form 8959.